Hookup Doc: Your Go-To Guide for All Things Dating

Explore the latest trends, tips, and advice in the world of dating and relationships.

Instant Gratification: Exploring the World of Instant Payout Systems

Discover the fast-paced realm of instant payout systems. Uncover the benefits, pitfalls, and how to maximize your earnings today!

What Are Instant Payout Systems and How Do They Work?

Instant payout systems refer to innovative financial solutions that enable users to receive their earnings, commissions, or rewards within a matter of seconds or minutes, as opposed to the traditional waiting period of days or weeks. These systems are particularly popular in industries such as freelance work, e-commerce, and affiliate marketing, where cash flow can significantly impact operations. By leveraging technology, such as payment gateways and blockchain, instant payout systems streamline the transaction process, providing the instantaneous satisfaction that both businesses and consumers crave.

The functionality of instant payout systems centers around integration with various payment platforms and processing technologies. When a transaction is initiated, the system verifies the payment method used and confirms the availability of funds. Once confirmed, the earnings are transferred directly to the user’s selected payment method, which could include digital wallets, bank accounts, or cryptocurrencies. This process often involves:

- Fast verification protocols to ensure security and transaction legitimacy.

- Direct integration with payment processors to facilitate real-time transfers.

- User-friendly interfaces that simplify the payout request process.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players can choose from a range of weapons, tactics, and strategies to outsmart their opponents. For those looking to enhance their gameplay experience, using a clash promo code can provide exciting in-game rewards.

The Pros and Cons of Using Instant Gratification Payment Solutions

Instant gratification payment solutions have gained immense popularity due to their ability to provide immediate access to goods and services. One of the main pros of using these solutions is the convenience they offer. Users can complete transactions quickly without the need for traditional banking processes, allowing for a seamless shopping experience. Additionally, these payment methods can enhance consumer satisfaction by eliminating the wait times associated with conventional payment options. Moreover, instant gratification payment solutions often include features such as reward programs, which can lead to additional savings and benefits for users.

However, there are also notable cons to consider when adopting instant gratification payment solutions. A significant downside is the potential for overspending, as the ease of use can lead consumers to make impulsive purchases without fully considering their financial situation. Furthermore, some of these payment methods may come with high fees or interest rates, leading to unexpected costs. It's essential for users to be cautious and aware of the financial implications that may arise from using these services too frequently, which can result in long-term debt.

Exploring the Future of Instant Payments: Trends and Predictions

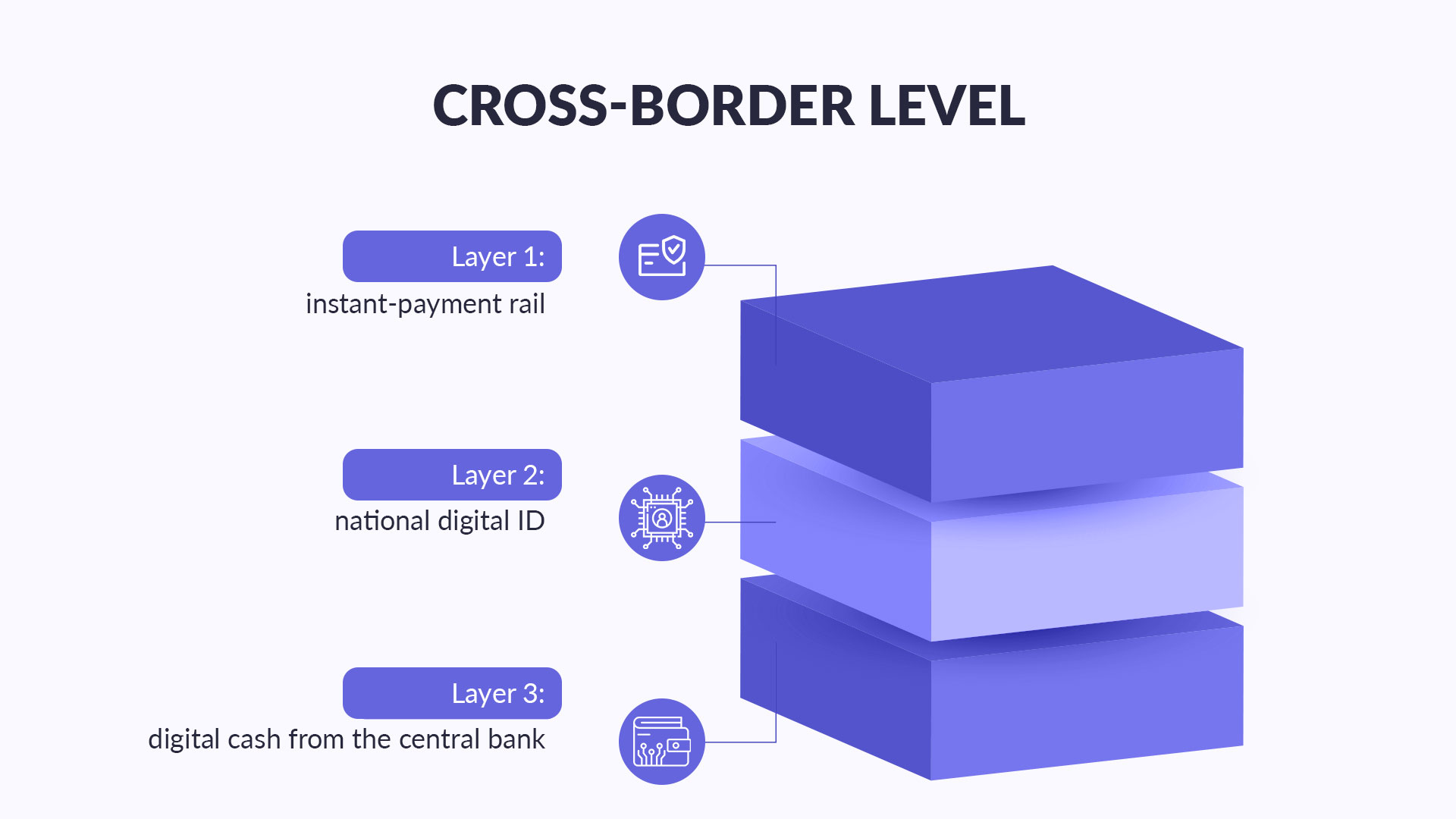

The landscape of financial transactions is rapidly evolving, particularly with the rise of instant payments. As technology continues to advance, we are witnessing a shift towards faster and more efficient ways to transfer money. This trend is driven by consumer demand for seamless experiences, with expectations for real-time transactions becoming the new norm. Many industries, including retail and services, are integrating instant payment systems to enhance customer satisfaction. According to recent studies, the global instant payments market is expected to grow substantially in the coming years, further solidifying its place in the financial ecosystem.

Looking ahead, there are several key trends that may shape the future of instant payments. Firstly, the adoption of blockchain technology is anticipated to increase, offering enhanced security and transparency for transactions. Secondly, we may see a rise in the use of mobile wallets and digital currencies, as consumers gravitate towards more convenient payment methods. Finally, regulatory developments will play a crucial role in shaping the landscape of instant payments, influencing how businesses and consumers engage with these systems. As these trends unfold, understanding their implications will be vital for both consumers and businesses alike.